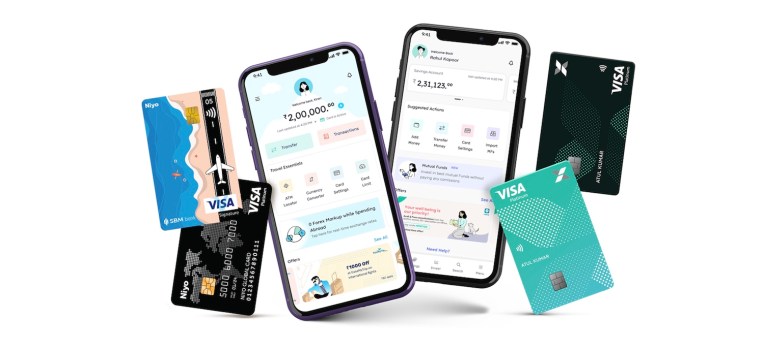

Indian neobank Niyo raises $100 million and surpasses 4 million customers – TechCrunch

India’s Niyo has raised $100m in a new funding round as the consumer-facing neobank platform seeks to add loans and other features to its offerings and make deeper inroads into the market. second largest Internet market in the world.

Accel and Lightrock India co-led the Bengaluru-based startup’s Series C funding round. Existing investors Prime Venture Partners, JS Capital also participated in the round, bringing the startup’s all-time raise by six years to around $150 million.

Niyo provides digital savings accounts and other banking services to widely salaried people in India. It works with banks to help them deliver a more modern and expansive user experience and features.

It also operates a wealth management product to help users invest in mutual funds and domestic stocks. Some of its most popular features include a zero percent forex markup and something called “change investing,” which rounds up a client’s expenses and invests a portion of it.

Niyo co-founder and chief executive Vinay Bagri told TechCrunch in an interview that the startup has amassed more than 4 million customers through its banking and wealth management products. Most of those customers are in their 20s and early 30s, he said.

A look at neobanks in India and the banks they have partnered with to serve customers. (Data: Enterprises and Jefferies. Image credits: Jefferies.)

The startup said it adds more than 10,000 new users every day and processes more than $3 billion in transactions on an annualized basis. Virender Bisht, Niyo’s co-founder and chief technology officer, said the startup has been seeing “massive tailwinds for digital financial products” since the pandemic hit.

“Launched less than a year ago, our one-of-a-kind ‘NiyoX’ product offering,” he said, “is democratizing the superior digital banking experience for users, and has witnessed a tremendous user adoption.”

Niyo plans to offer loans to customers starting next month. Loan sizes will be in the range of ₹70,000 ($930). As it expands its offerings, it also seeks inorganic growth via acquisition opportunities, Bagri said.

Dozens of startups are trying to modernize the banking experience in India. But the challenge they face is that, unlike many countries, banking services are very affordable in India, making it difficult for them to convince customers to make what is a big change.

As one industry executive described to TechCrunch, the current generation of neobanks largely offers only an “experience layer” to customers. But many startups hope India will soon grant them a license to own and operate their own digital-only banks.

“We are delighted to support India’s fastest growing neo-bank, Niyo. Vinay, Viren and their team have built a fantastic product with clear value for customers which is reflected in their phenomenal growth. We look forward to partnering with Niyo to change the way Indian banks are used,” Anand Daniel, Partner at Accel, said in a statement.

Comments are closed.