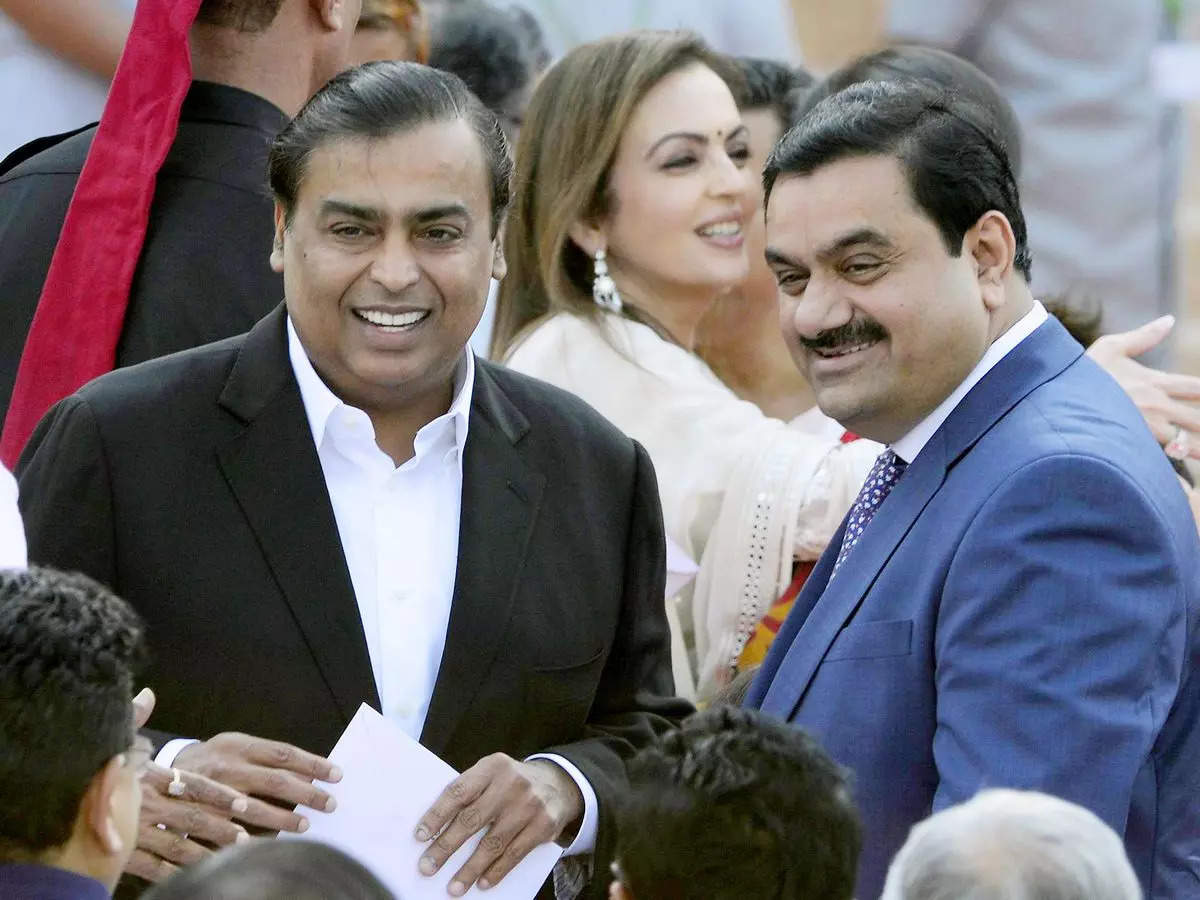

Mukesh Ambani and Gautam Adani account for $1 in $5 of foreign loans

- External Commercial Borrowing, or ECB, is a crucial source of funding to help businesses meet their financing needs.

- Falling interest rates in foreign markets is one of the reasons companies choose to borrow in foreign currencies.

- While India Inc. borrowed $38 billion from

foreign lenders India’s richest menAmbani andAdani alone accounted for more than a fifth.

Now, a report based on Reserve Bank of India data shows that Ambani and Adani together borrowed more than $1 out of $5 from foreign lenders.

In total, Indian companies borrowed $38.2 billion from foreign lenders in 2021-22. Of this amount, Reliance Industries of Mukesh Ambani and the companies headed by Gautam Adani have borrowed $8.25 billion.

While ECBs are lucrative due to lower interest rates, especially in the United States, Japan and Europe, exchange rate volatility remains an issue that businesses need to proactively manage.

This, according to a report by Bank of Baroda, will be a headwind for companies considering BCEs.

“However, with global central banks in a monetary policy tightening cycle, interest rates are likely to rise. This may lead to moderation

ECBs fell by a third due to Covid, but are regaining strength

Over the past eight years, Indian companies have borrowed nearly $260 billion from overseas markets – this includes capital markets, commercial banks, equity investors, among others.

Interestingly, ECBs continuously declined during the early years of the Modi government, only to pick up again in 2017. The Covid-19 pandemic again acted as a speed breaker, but now it is accelerating again.

A large part of the BCEs are concentrated in three sectors: financial services, oil and electricity.

External Commercial Borrowing, or ECB, is a cheap source of funds, allowing Indian businesses to tap into overseas markets with cheaper interest rates to finance working capital, capital expenditure, expansion or expansion. other financing needs.

Following the ECB’s lead allows companies to reduce their overall cost of debt, which plays a critical role in an entity’s financial performance.

SEE ALSO:

Vodafone Idea will have a solid war chest if it closes the deal with Amazon

These four drone company stocks have given record returns in a year

Modi government’s itch to offload ₹40,000 crore of Hindustan Zinc stake hints at bigger deficit than initially expected

Comments are closed.