“PSU banks’ books are better than those before Covid”

Mumbai: Public Sector Banks (PSBs) got much stronger after the pandemic due to the cleanup and consolidation that preceded it. In an interview with TOI, Rajkiran Rai, Managing Director and CEO of Union Bank of India (and former Chairman of the Association of Indian Banks), which absorbed Corporation Bank and Andhra Bank as part of the PSB consolidation , talks about the past year and what lies ahead. …

How did 2021 go for the bank?

It started with positive signals and in March the banks ended fiscal 21 with better balance sheets. In April and May we saw some disruption because of the second wave. It was very brutal, we lost a lot of precious lives, but our people got down to work and worked hard to bring it back to normal. We should also give it to the people of the country and the resilience with which the economy rebounded after June. Whether it’s asset quality, stress levels or collection efficiency, banks are in a better position than before Covid. But what happened in the first and second quarters led to slippages. These were reflected in the first and second quarter results.

What are the lessons for the economy that can be used for the third wave?

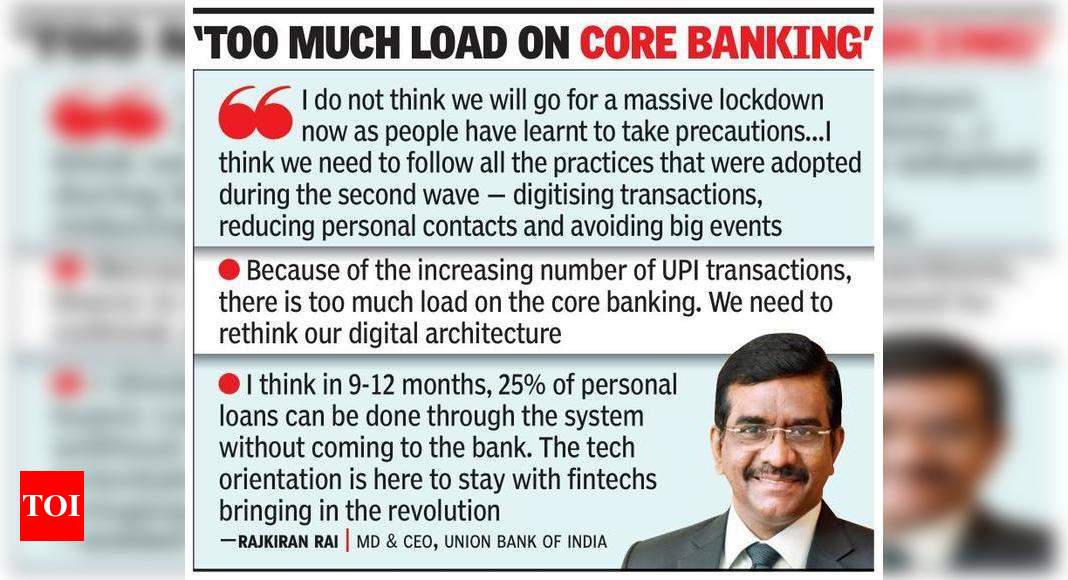

The complete foreclosure of the first wave disrupted the economy. This was required at the time and most countries followed this principle. The second wave lockdown was more location specific. Thus, disruptions to the economy, supply chain and production have been localized. This made it possible to bounce back quickly. I don’t think we’ll go for a massive lockdown now because people have learned to take precautions. Many subject matter experts say there are fewer hospitalizations with Omicron, but this is not known and care should be taken. I think we need to follow all the practices that were adopted in wave two – digitize transactions, reduce personal contact, and avoid big events.

How successful were you in completing the post-merger restriction?

We managed to complete the technology integration in 10 months due to planning. Today we are double the size of the old Union Bank and four times the size of the Corporation. We have over 5% market share, branch offices in 15 states and 22 states, our enterprise market share is over 5% by volume. We are now planning Samarth 2.0, which must take the bank to the next level in digitization, both in terms of technology and savvy human resources. We have created a separate digitization department, hired HR consultants and are hiring specialists.

What about the associated companies and subsidiaries of the old banks?

We are in the process of selling our stake in India First Life Insurance as we cannot hold an interest in more than one life insurance company. We are also selling our stake in ASREC (asset reconstruction company). We have already renamed CorpBank Securities to UBI Services and developed it as a marketing engine. Today, 40% of our retail business is generated by our vertical market of 1,000 members. We plan to replicate this success in UBI Services.

The banks which have consolidated have lost market share … What ambition for the future?

Over the past four or five years, PSBs have lost market share because they were on a consolidation path – balance sheet correction, bad debt recognition, provisioning and capital raising, and then there was the merger. Now, we must first focus on maintaining market share, for which we must grow in line with the industry. I am optimistic that by the end of FY 22 we will grow in line with the industry. From next year we have to grow faster than the industry and the digitization process is in this line. We are already competitively priced – only technology and products make the difference. Once we have that, customers have no reason to go anywhere else. By March, we’ll be launching our full-fledged trade finance module, which gives businesses full control from their desk.

Are there any efficiencies that have been made in earnest during the pandemic?

Digital transactions have increased. Today we have personal loans and Mudra loans which are end to end digital, even MSME loan renewals can be done end to end online. I think in 9-12 months at least 25% of personal loans can be done through the system without having to go to the bank to get documents. The technological focus is here to stay with fintechs bringing the revolution. FinTechs identify the weak points of customers and offer a product there. For me, this is an opportunity to collaborate because they have already built the technology and are quite agile. At the same time, they don’t have the balance sheet support that we have.

How did 2021 go for the bank?

It started with positive signals and in March the banks ended fiscal 21 with better balance sheets. In April and May we saw some disruption because of the second wave. It was very brutal, we lost a lot of precious lives, but our people got down to work and worked hard to bring it back to normal. We should also give it to the people of the country and the resilience with which the economy rebounded after June. Whether it’s asset quality, stress levels or collection efficiency, banks are in a better position than before Covid. But what happened in the first and second quarters led to slippages. These were reflected in the first and second quarter results.

What are the lessons for the economy that can be used for the third wave?

The complete foreclosure of the first wave disrupted the economy. This was required at the time and most countries followed this principle. The second wave lockdown was more location specific. Thus, disruptions to the economy, supply chain and production have been localized. This made it possible to bounce back quickly. I don’t think we’ll go for a massive lockdown now because people have learned to take precautions. Many subject matter experts say there are fewer hospitalizations with Omicron, but this is not known and care should be taken. I think we need to follow all the practices that were adopted in wave two – digitize transactions, reduce personal contact, and avoid big events.

How successful were you in completing the post-merger restriction?

We managed to complete the technology integration in 10 months due to planning. Today we are double the size of the old Union Bank and four times the size of the Corporation. We have over 5% market share, branch offices in 15 states and 22 states, our enterprise market share is over 5% by volume. We are now planning Samarth 2.0, which must take the bank to the next level in digitization, both in terms of technology and savvy human resources. We have created a separate digitization department, hired HR consultants and are hiring specialists.

What about the associated companies and subsidiaries of the old banks?

We are in the process of selling our stake in India First Life Insurance as we cannot hold an interest in more than one life insurance company. We are also selling our stake in ASREC (asset reconstruction company). We have already renamed CorpBank Securities to UBI Services and developed it as a marketing engine. Today, 40% of our retail business is generated by our vertical market of 1,000 members. We plan to replicate this success in UBI Services.

The banks which have consolidated have lost market share … What ambition for the future?

Over the past four or five years, PSBs have lost market share because they were on a consolidation path – balance sheet correction, bad debt recognition, provisioning and capital raising, and then there was the merger. Now, we must first focus on maintaining market share, for which we must grow in line with the industry. I am optimistic that by the end of FY 22 we will grow in line with the industry. From next year we have to grow faster than the industry and the digitization process is in this line. We are already competitively priced – only technology and products make the difference. Once we have that, customers have no reason to go anywhere else. By March, we’ll be launching our full-fledged trade finance module, which gives businesses full control from their desk.

Are there any efficiencies that have been made in earnest during the pandemic?

Digital transactions have increased. Today we have personal loans and Mudra loans which are end to end digital, even MSME loan renewals can be done end to end online. I think in 9-12 months at least 25% of personal loans can be done through the system without having to go to the bank to get documents. The technological focus is here to stay with fintechs bringing the revolution. FinTechs identify the weak points of customers and offer a product there. For me, this is an opportunity to collaborate because they have already built the technology and are quite agile. At the same time, they don’t have the balance sheet support that we have.

Comments are closed.