Raids of October 7: IT department uncovered unrecorded income from two real estate companies linked to Ajit Pawar’s family

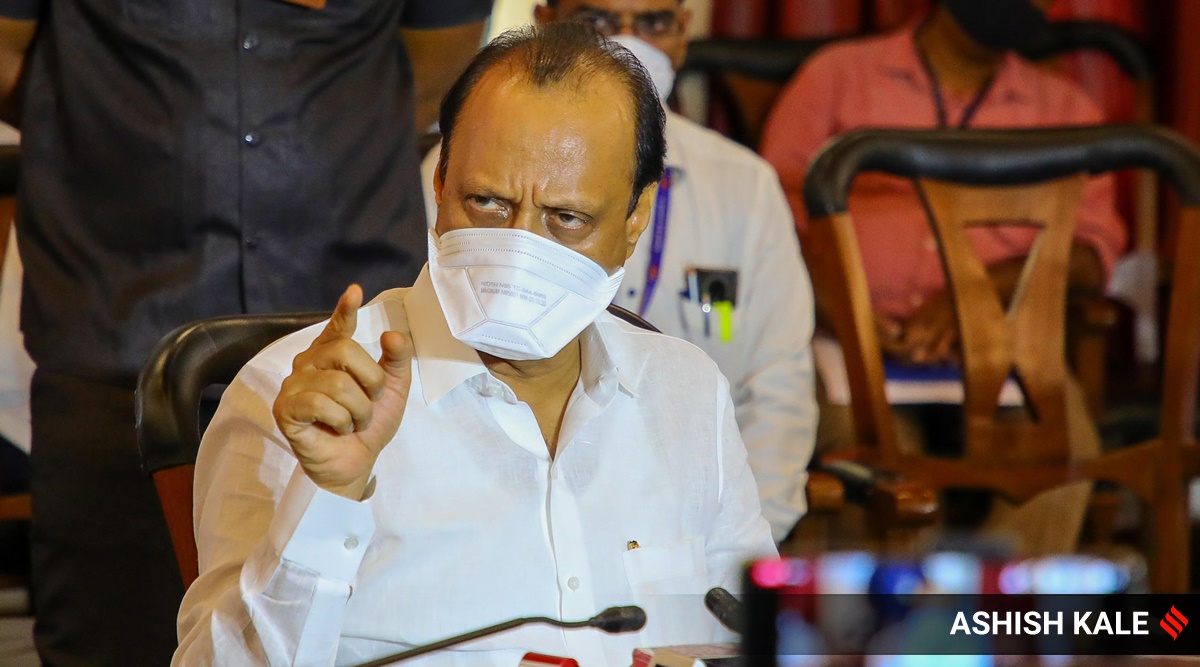

The Income Tax (IT) department said on Friday it discovered unrecognized income worth Rs 184 crore after its research on October 7 at the premises of two real estate groups in Mumbai linked to the family of Maharashtra’s Chief Deputy Minister Ajit Pawar.

Without naming Pawar or his relatives, the tax administration said that the evidence it gathered during searches of around 70 premises in Mumbai, Pune, Baramati, Goa and Jaipur revealed “several seemingly unrecorded transactions and benami “.

“Offending documents proving unrecorded income of around Rs 184 crore from the two groups have been found,” the tax agency said in a statement Friday.

On October 7, the tax agency raided a business where Pawar’s son Parth is a manager; some businesses owned by the Pawar sisters; two real estate companies linked to Pawar; and the offices of the directors of four sugar factories across the state who are said to be indirectly linked to the Pawar family.

At the time, Pawar said he had no problem with the research against him, but was upset that his sisters were involved. “We pay taxes every year. Since I am the Minister of Finance, I am aware of fiscal discipline. All the entities related to me have paid taxes, ”he said.

“I am upset because (the premises of) my sisters, who married 35-40 years ago, have been raided. If they were raided as Ajit Pawar’s parents, then people have to think about it… the way the agencies are used, ”he said, adding that the tax department was in a better position to tell s ‘there was a political angle to the searches.

The IT department said in its statement Friday that it discovered that the two real estate companies had infused unrecorded funds in several companies through “suspicious” transactions with “the involvement of an influential family in Maharashtra.”

“The research action made it possible to identify the transactions of these groups of companies with a network of companies which, at first glance, seem suspicious. A preliminary analysis of fund flows indicates that there has been an introduction of unrecorded funds into the group through various dubious methods such as the introduction of bogus issue premiums, suspicious unsecured loans, receipt of ‘unjustified advances for certain services, collusive arbitration of non-existent conflicts, etc. It was observed that such a suspicious flow of funds took place with the involvement of an influential family from Maharashtra, ”the statement said.

According to the agency, the unrecorded funds were used for “the acquisition of various assets such as an office building in a prime area of Mumbai, an apartment in an upscale town of Delhi, a beach resort in Goa, agricultural land in Maharashtra and investments in sugar factories “.

“The book value of these assets is approximately Rs 170 crore,” the tax administration said. Apart from that, the department seized unrecorded cash worth Rs 2.13 crore and jewelry worth Rs 4.32 crore from both companies during the searches.