Indian Overseas Bank lost six and a half years to clean up bad loans, but the market is cheering

- Indian Overseas Bank shares hit new highs as the Reserve Bank of India (RBI) pulled it out of its Rapid Corrective Action (PCA) framework.

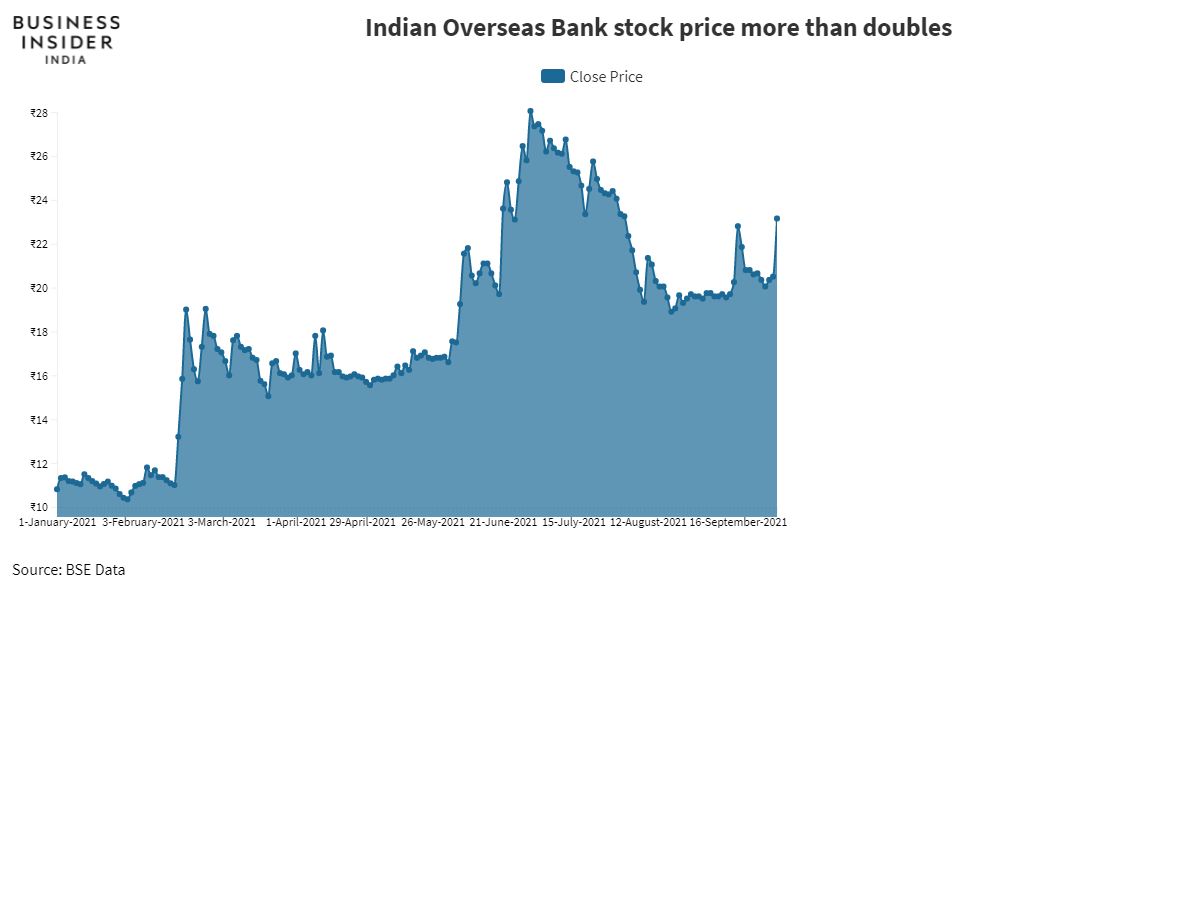

- IOB shares rose 13% Thursday morning to hit 23.15 each, at 10:30 am. Since the start of the year, the stock has jumped about 114%.

- Earlier this month, the RBI pulled UCO Bank out of the PCA regime, while IDBI Bank was pulled in March. The Central Bank of India is now the only lender not yet to be exited from the framework of the PCA.

Indian Overseas Bank shares hit new highs as the Reserve Bank of India (RBI) pulled the bank out of the Rapid Corrective Action (PCA) framework after nearly six years.

As Indian Overseas Bank emerged from the shadow of the PCA, its shares rose 13% Thursday morning to 23.15 each, at 10:30 am. Since the start of the year, the stock has jumped about 114%.

Simply put, the central bank’s BCP framework places lending and activity limits on commercial banks if they violate its rules on regulatory capital, bad debts, and leverage ratio. In 2017-18, the RBI had placed 11 public sector lenders under PCA, which at the time accounted for nearly a fifth of system-wide lending and deposits. The nature and degree of restrictions under PCA are based on thresholds and depend on the financial profile of each bank. Earlier this month, the RBI pulled UCO Bank out of the PCA regime, while IDBI Bank was pulled in March. The Central Bank of India is now the only bank that has not yet exited the framework of the PCA.

After being placed under the PCA regime, IOB’s market share has been steadily declining. Between fiscal 2016 and 2021, its market share in deposits almost halved from 2.5% to 1.6%, while in net lending it fell to 1.2% from 2 , 3%, according to a note dated September 22 from the rating company India Ratings.

“However, Ind-Ra [India Ratings] believes that after spending six years under the PCA, if and when the bank comes out of the same, it would take some time to accelerate lending as far as possible (through the different stages of a cycle (including increasing the strength of the existing teams), ”he said.

Overseas Indian Bank: Financial Profile

| FY21 | FY20 | |

| Total assets (₹ billion) | 2,740 | 2 607 |

| Net profit (₹ billion) | 8.31 | -85.3 |

| Return on average assets (%) | 0.3 | -3.3 |

| Capital adequacy ratio (%) | 15.32 | 10.72 |

| Source: Ind-Ra |

SEE ALSO:

Cardano is no longer the third largest cryptocurrency in the world

Cloudy corruption case, allegedly on behalf of Amazon, has many unanswered questions

Zee Entertainment, Blue Dart, IRCTC, and more to watch on September 30