Privatization can be launched, push health and PLI

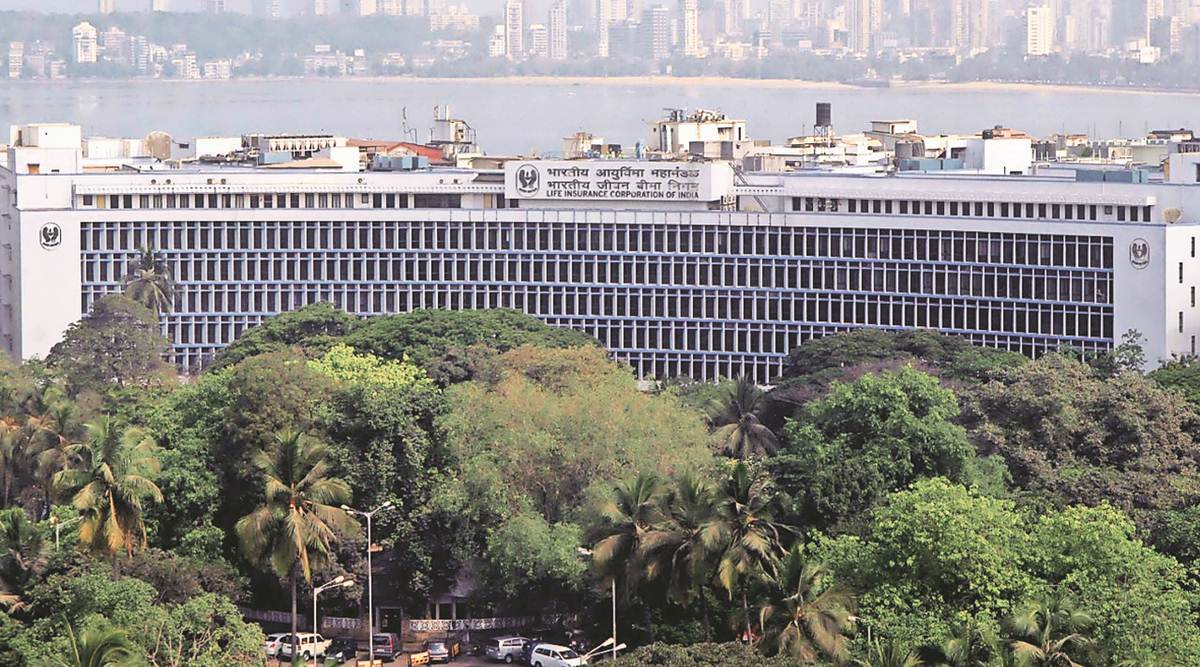

Among key reforms unveiled in the 2021-22 budget, the privatization of two state-owned banks and downstream oil major BPCL is now set to stretch into next year, even as the Center fights against time to make IPO Life Insurance Corporation before that date. the quarter is over. Depending on the size of the offering, LIC’s IPO could help the Center partially meet its FY22 divestment target of Rs 1.75 lakh-crore, of which only about 5.3%, or Rs 9,329.90 crore, has been increased so far, according to official data. .

While the enabling framework for the privatization of one of the four general insurance companies – a key budget announcement – has been concluded, with amendments to the General Insurance Companies (Nationalization) Act pending approval during the monsoon session of Parliament, the insurer targeted for the sale of the stakes is not yet finalized. Market participants expect the sale of IDBI Bank’s pending stake to be delayed. Progress on a set of other proposals presents a mixed bag.

Framed against the backdrop of a record contraction last year, the 2021-22 budget aimed to “support and facilitate the reset of the economy” to ensure sustainable growth. Privatization and monetization of assets were the key elements of this planned economic reset. While the government could sell Air India to the Tata group and set up a nationwide monetization pipeline, the privatization of state-owned banks has yet to gain momentum.

The Banking Laws (Amendment) Bill 2021 “concerning the privatization of two public sector banks” has been listed for introduction in the just-concluded Winter Session of Parliament. But it was not taken up by Cabinet while a draft was ready, an official said. Opposition from banking unions to privatization, the withdrawal of the Center on Farm Laws and the upcoming Assembly elections were reportedly factors behind the delay.

Other companies awaiting privatization include: Shipping Corporation of India, BEML, Neelachal Ispat Nigam Limited, Container Corporation of India and Pawan Hans. The government has received financial offers for Pawan Hans and Neelachal Ispat Nigam, and the privatization process has entered its final phase.

Under the plan to reset the economy, new dynamism is seen in direct and indirect tax collections, and higher dividends from state-owned enterprises as well as the Reserve Bank of India are seen as contributing to government revenue . This would help close the gap making the 6.8% budget deficit target possible, despite higher than expected spending on the purchase of vaccines, the fertilizer subsidy and the clearance of incentive arrears. export worth Rs 56,000 crore, sources said.

According to India Ratings, gross tax revenue collection in FY22 is estimated to be Rs 5.9 lakh crore higher than the budgeted figure.

Substantial progress has, however, been made in other key health sector budget announcements: spending on better health care infrastructure, production-related incentive programs and mega-parks for investment in textile sectors. . The National Bank for Infrastructure and Development Finance and the National Asset Reconstruction Company Ltd were established.

Among other financial sector proposals, deposit insurance coverage has been increased to Rs 5 lakh per account from Rs 1 lakh earlier, while the foreign direct investment (FDI) cap has been increased to 74% from 49% as proposed in the budget. An insolvency resolution pre-package framework has also been introduced for MSMEs.

Queries sent by The Indian Express to the Ministry of Finance went unanswered.

On the fiscal side, the government had proposed to make some changes to the faceless assessment regime. During the year, it relaxed standards for taxpayers wanting a personal hearing while appealing against a tax claim. The government had also proposed to create a faceless National Income Tax Appeal Tribunal with full electronic communication, which has yet to be set up. As private investment and consumption have fallen following the pandemic, government investment spending has increased. But its pace was slower than the budget had anticipated. From April to November, the government has committed 49.4% or Rs 2.73 lakh crore of its total capex fiscal target.

The 2021-2022 Union Budget had forecast a down payment of Rs 5.54 lakh crore – a jump of 34.5% from the 2020-21 budget estimates. The government had also earmarked more than Rs 2 lakh crore for states and self-governing bodies for their capital expenditure. Officials argued that capital spending would come close to target due to lumpy spending in the last quarter.

Behind the less than expected investments are the delay in the sale of stakes and the second and now the third Covid wave affecting the execution of projects. Apart from privatization, asset monetization is the other step of the “economic reset” and the government has set up a four-year National Monetization Pipeline (NMP) worth an estimated Rs 6 lakh crore.

Comments are closed.