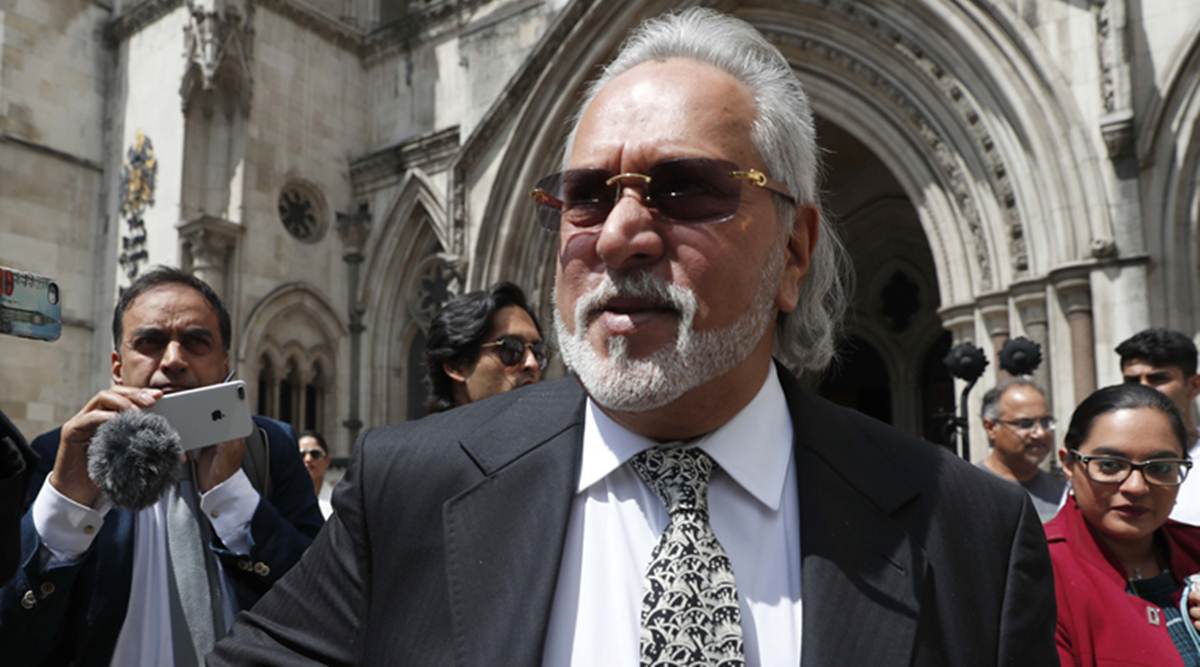

Mallya loan default case: Court tribute to banks for restoring properties worth over 5,600 crores

A special court in two separate orders recently issued authorized the restoration of the properties of businessman Vijay Mallya and companies linked to him from a consortium of banks, led by the State Bank of India, to recover the amount of the loan due in excess of Rs.5,600 crore.

Special Judge JC Jagdale said the claimants for the properties are public sector banks and have suffered a “quantifiable loss”. The court also said Mallya himself offered to replace the amount owed to him, as he now opposes the demand for restitution to recover the losses suffered by the banks. “… It is important to note that the applicants are public sector banks and these banks deal with public money. There can be no personal or private interest of said plaintiffs in pursuing such a claim against the present Respondents (Mallya, Kingfisher Airlines and other companies) and defendants. Therefore, it can be safely concluded that this was done in good faith, â€the court said.

“Regarding the” quantifiable loss “, it is obvious that the plaintiffs suffered losses … The claim of the applicant banks of Rs 6203,35,03,879,42 is not imaginary”, added the court, authorizing properties valued at over Rs. 5,600 crore to be restored for recovery.

Real estate properties include apartments under construction at Kingfisher Tower in Bengaluru, property in UB City and apartment in Grant Road in Mumbai, among others.

After the registration of a case by the Directorate of Enforcement against Mallya and other companies concerned, the assets related to them were provisionally seized. The consortium of banks, which had granted them loans, had requested the recovery of Rs 5,600 crore by applying to the Debt Recovery Tribunal (DRT) of Bengaluru.

In 2017, their claims were admitted by the DRT, which ordered the banks to pay the claim amount with 11.5% interest. The appeals lodged by the companies have been rejected in various instances. The banks approached the special court, requesting the release of the attached properties so that the debt collector could continue the proceedings.

Mallya and his companies opposed the plea, saying the properties had been acquired many years ago and were not the proceeds of crime. It was also alleged that the plea was not sustainable because the appeals against their seizure by the ED were pending. The companies also said the banks’ plea was premature and that the loan obtained from them for Kingfisher Airlines was for “very legitimate purposes.”

The court dismissed the claim, saying the accounts of these companies show that despite poor financial conditions, Kingfisher Airlines Limited transferred the loan amount to the Formula 1 Force India racing team, also controlled by Mallya.

The court said that at first glance this showed “falsification of accounts and embezzlement” and added that it was not the step to decide the criminal responsibility of the accused.

“Even the accused Dr Vijay Mallya himself made a proposal to replace the amount owed. Had there really been no loss for the Applicant Banks, so why is Dr Vijay Mallya prepared to reimburse the loss? The court asked on May 24.

He also said other third-party claimants will need to approach the DRT. The court ordered the debt collector through whom the restoration will take place and the banks to post a commitment bond, in accordance with the collection certificate issued by the DRT in 2017. The properties are listed in the submitted schedules. by the ED, which had given its non-objection by means of the banks.

Mallya is the subject of extradition proceedings in the UK and was declared a financial offender on the run to India in 2019.